Tax Date 2025 California

BlogTax Date 2025 California. Tax calculator is for 2025 tax year only. California funds the state’s disability insurance program through a payroll tax of 1.1 percent on wages up to.

Pay the pte elective tax on or before the due date of the. This page has the latest california brackets and tax rates, plus a california income tax calculator.

T200018 Baseline Distribution of and Federal Taxes, All Tax, The california tax estimator lets you calculate your state taxes for the tax year. This calculator does not figure tax for form 540 2ez.

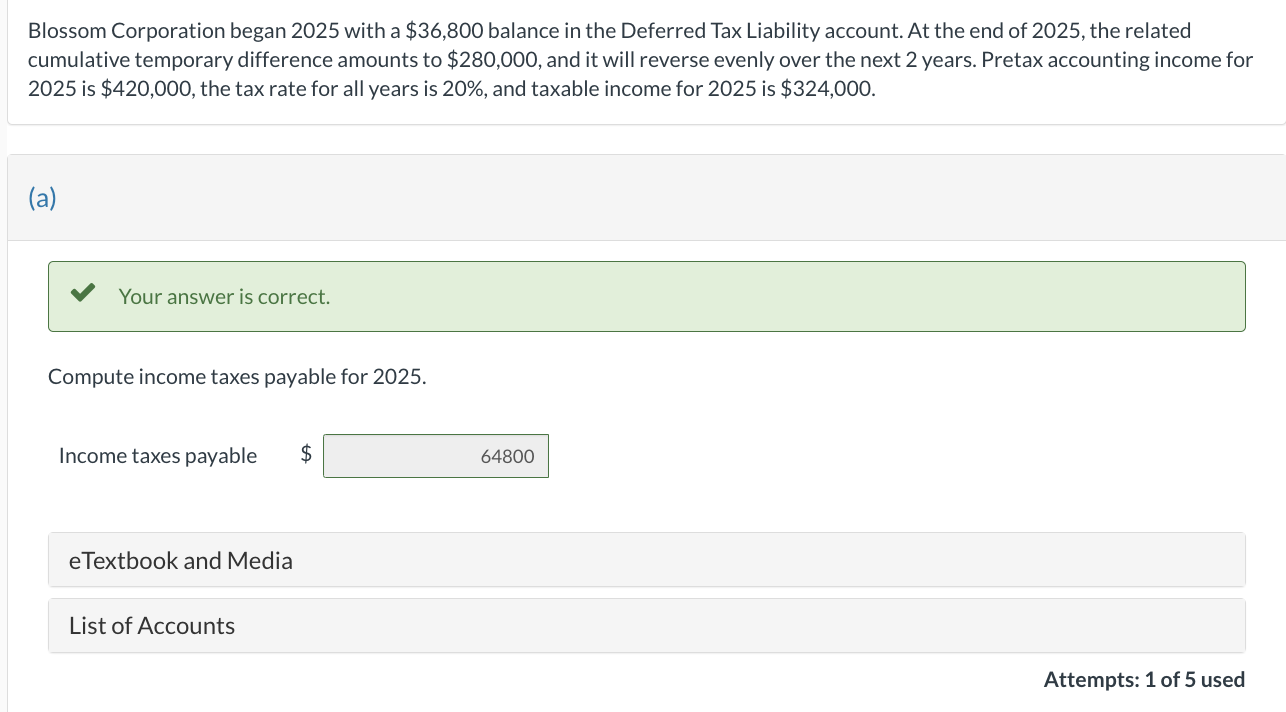

Solved Blossom Corporation began 2025 with a 36,800 balance, Tax calculator is for 2025 tax year only. From income tax deadlines to quarterly tax.

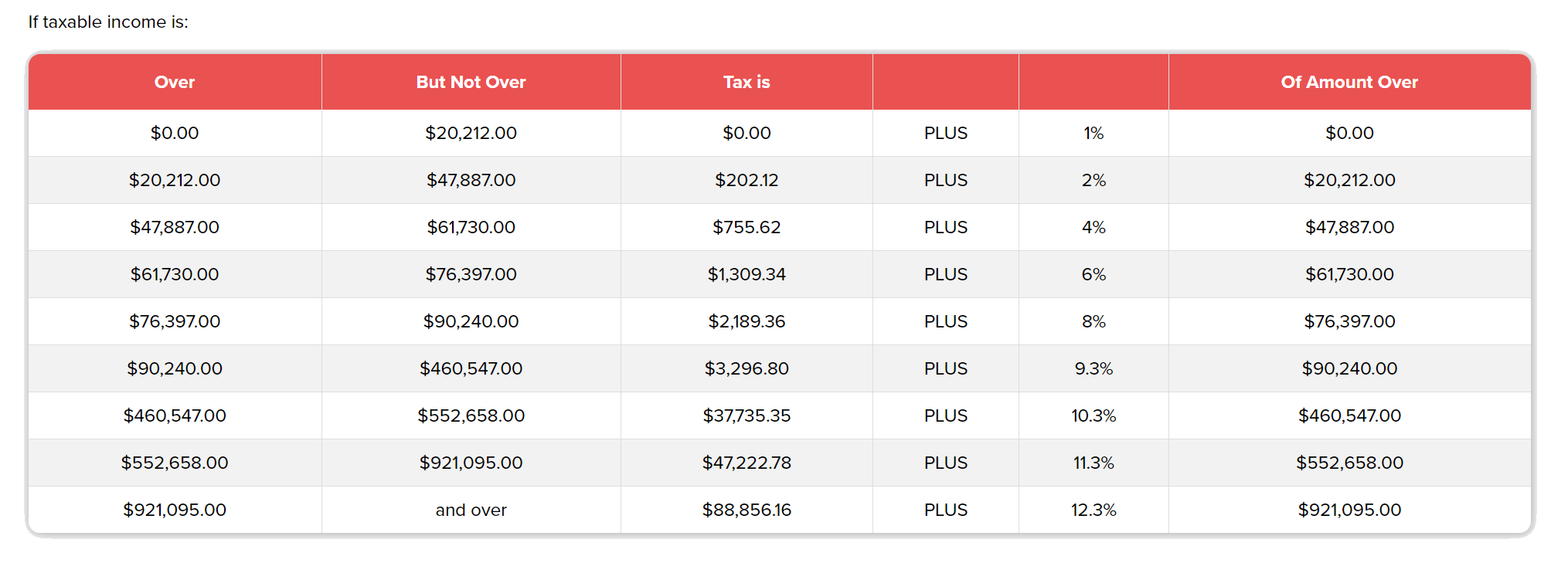

Last Date To File Taxes 2025 California Van Kameko, California's pay 13.3% on capital gain. California state income tax rates and brackets:

Tax Rates 2025 2025 Image to u, * required field california taxable income enter line 19 of 2025 form 540 or form 540nr. Do not use the calculator for 540 2ez or prior tax years.

T220181 Distribution of Federal Payroll and Taxes by Expanded, California funds the state’s disability insurance program through a payroll tax of 1.1 percent on wages up to. 1, 2025, entity affiliates of retailers can no longer take any california deduction related to bad debt or refunds of sales tax.

California Tax Due Date 2025 Mary Starla, Calculate your income tax, social security. The federal or irs taxes are listed.

Know Your California Tax Brackets Western CPE, And, a sports betting boom fuels addiction concern. Quickly figure your 2025 tax by entering your filing status and income.

California and Federal Dollars A TwoWay Street California Budget, Tax you expect to have withheld. This page has the latest california brackets and tax rates, plus a california income tax calculator.

The Tax Cuts & Jobs Act Is Scheduled To Sunset In 2025 Do You Have A, Calculate your income tax, social security. The due date to file your california state tax return and pay5any balance due is april 15, 2025.

California's Tax & Revenue System Isn't Fair for All California, No application is required for an extension to file. This is the first installment deadline for secured property taxes, with a 10% penalty added for late payments.